Government Schemes

Employees’ State Insurance Scheme

by admin

23rd November 2023

5 minutes read

The Employee State Insurance Corporation Scheme (ESIC) is a health scheme. The scheme was inaugurated on the 24th of February, 1952 in Kanpur by the then Prime Minister Pandit Jawaharlal Nehru. It was established with the aim of providing financial protection to insured workers and employees in times of illness, death or incapacity. It was simultaneously launched in Delhi too.

The scheme/policy saw improvements in the year 2015, wherein the scheme benefits were extended to the workers deployed on the construction sites (located in the implemented areas under the ESI Scheme). Currently, over 7 lakh factories are covered by the programme.

To avail of its benefits, one should be employed in an organization (a non-seasonal company) with an employee capacity of over ten employees and should be earning up to Rs. 21,000/month. The scheme covers various types of treatments, including three years of unemployment and 26 weeks of maternity, in addition to providing sickness and disablement benefits.

Employees State Insurance Scheme (ESIS): Coverage/Eligibility

Most Indian residents can receive the benefits of this scheme. The scheme is currently availed by over 8.28 crore people and covers the following:

- Employees working at newspaper establishments, cinemas, restaurants, hotels and shops.

- People working in medical and private educational institutes with an employee capacity of at least ten.

ESIC does not cover those earning over R. 21,000, or Rs. 25,000 in case of a disability. In states like Maharashtra and Chandigarh, the minimum employee capacity of the organizations needs to be at least 20.

Moreover, if one’s wages exceed Rs. 21,000 in a particular month, coverage will be given till the end of the contribution period. Contribution will be deducted and paid based on the total wages earned.

Employees State Insurance Scheme: Benefits/Features

- Medical facilities to the insured; insurance coverage from day one of his/her employment.

- 90% monthly wage for an employee/worker with temporary disability till recovery; 90% monthly wage for a lifetime in case of permanent disability.

- 100% daily wages for up to 26 weeks of maternity; 100% daily wages for miscarriage (up to six weeks) and adoption (up to 12 weeks).

- 70% daily wage for a maximum of 91 days of medical leave; this facility can be enjoyed twice a year.

- Financial assistance to the dependents of the beneficiaries/insured in case of illnesses.

- 50% average monthly wage for the unemployed or when there’s permanent invalidity due to an injury.

- Confinement costs are receivable when the confinement occurs where there’s no healthcare under ESIC.

- Rs. 120/annum for the insured/spouse after retirement after 60 years of age.

Steps to Register for ESIC

- Visit the ESIC portal, sign up with your details (such as name, employer’s name, etc.), click on the checkbox and submit.

- You will receive login credentials on your email ID.

- Login to the ESIC portal with these credentials, select ‘New User Registration’, choose your unit type and submit.

- Now you’ll be redirected to a page where you’re supposed to submit your unit’s name, factory’s address and its nearest police station.

- Select ‘Next’, enter the nature and category of the business, and again click on ‘Next’.

- Enter the business’ commencement date, choose the constitution of ownership and ownership details, and select ‘Save’.

- Enter the employee strength of the factory you work in and the number of employees with less than Rs. 21,000 monthly income. Click on ‘Save’.

- Enter the date of the hiring of the first ten employees, and click on ‘Employee Declaration Form’.

- Enter IP’s name, father’s name, gender, date of birth, family details, date of joining and marital status, and submit.

- Upon being redirected to a new page, choose the ESI branch office and inspection division and submit.

- Click on ‘Pay Initial Contribution’, submit and continue to make the ESIC payment.

Note: To log in to ESIC, you’ll need to visit the official website, click on ‘Employee/Insured Login’ and enter your login ID, password and the Captcha code.

Applying for the ESI Card (Pehchan Card)

The ID card required to receive the benefits ESIS at the network hospitals contains the insured’s name, father’s name, address, unique ESI number, and the insured’s and his/her dependent’s passport-size photo.

Steps to download the ESI Card:

- Visit the ESIC login portal, and log in using your credentials.

- Click on ‘Employee’, then on e-Pehchan Card.

- Then choose the unit details, and click on ‘View’ to view the details of all workers.

- Choose ‘View Counter Foil’ against the respective employee; ‘Counter Foil’ refers to the ‘e-Pehchan Card’.

- Print to download the same in PDF format.

- Sign in to the hard copy of the document along with your dependents’ photos. The photo should be attested by the ESIC official or your employer.

Documents Required to Apply for the Scheme

- Memorandum and Articles of Association

- Factories Act and Establishment Act registration certificate

- List of all employees of the enterprise

- Address proof of all employees (including PAN card)

- Names of the company’s directors and shareholders

- The company’s annual income details

- Cancelled cheque leaf

For ESI returns, the documents required include the register for Form 6, the attendance register, the register of wages, the inspection book, the register of any accidents on the premises, and returns and monthly challans submitted for ESI.

Steps to Online Check the Claim Status of ESIC

- Open the UMANG app, enter your ESIC insurance number and select ‘Get OTP’.

- Enter the OTP (received on your registered mobile number) and submit.

- Go to ‘Services’, then ‘Claim Status’ and you’ll be able to see the required status for the claim raised.

Conclusion:

The Employees’ State Insurance Scheme (ESI Scheme) is an integrated measure of the Social Insurance embodied in the ESI Act (Employee’s State Insurance Act). It is funded by contributions from employees (1.75% of the wages payable to the employee) and employers (4.75% of the wages payable to employees). Employees earning less than Rs. 137/day are exempted from sharing such contribution payments.

Today, the scheme stands implemented at more than 843 centres in 33 states and union territories.

Helpline number (toll-free): 1800-11-2526

CATEGORIES

- ACL Reconstruction

- Anal Fissures

- Anal Fistula

- Appendicitis

- ASK A DOCTOR

- Benign Prostatic Hyperplasia

- Breast Lump Excision

- Cataract

- Circumcision

- Conditions & Diseases

- Cosmetology

- Covid-19

- Cure

- Endocrinology

- ENGLISH VIDEOS

- Eye Care

- Gallstones

- General Surgeries

- Government Schemes

- Gynaecology

- Gynecomastia

- Gynecomastia

- Health

- Health Insurance

- Hernia

- hindi

- Hip Arthoscopy

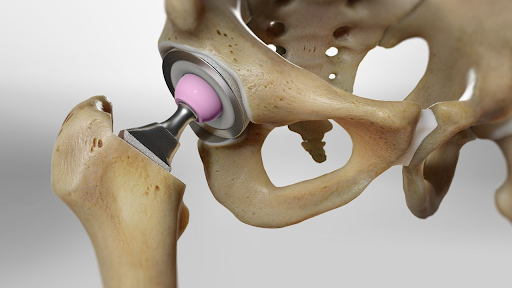

- Hip Replacement

- Hip Replacement Surgery

- Hydrocele

- Kannada

- Kidney Stones

- Knee Arthroscopic

- Laparoscopic

- LASER

- Latest Treatments

- Lifestyle

- Liposuction

- Medfin Stories

- Medicine

- Nephrology

- Ophthalmology

- Orthopaedic

- Paraphimosis

- Patient Testimonials

- PCL Reconstruction

- Phimosis

- Piles (Hemorrhoids)

- Pilonidal Sinus

- Proctology

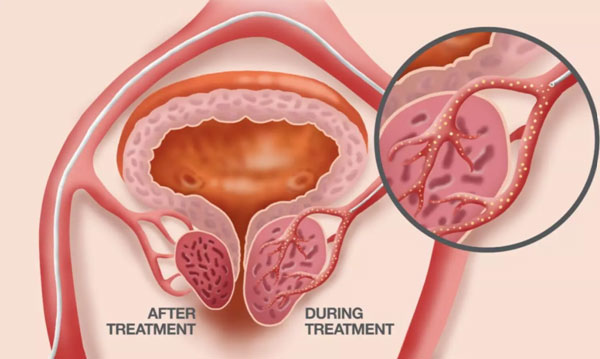

- Prostate Artery Embolization

- Rhinoplasty

- Second Opinion

- Total Knee Replacement

- Uncategorised

- Urology

- uterine artery embolization

- Uterine Fibroids

- Varicocele

- Varicose Veins

- Vascular

- VIDEOS